Convenience Store Insurance

Convenience Store Insurance in Houston

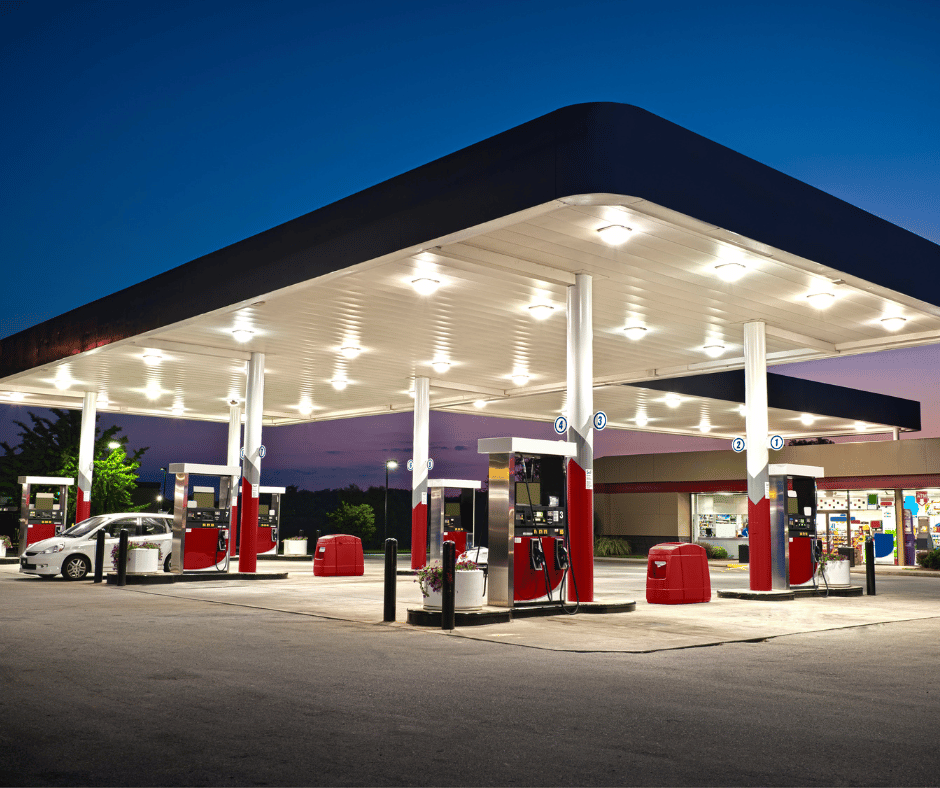

Today’s convenience stores have evolved to offer a wider range of products and services beyond the traditional items. Many now have expanded food and beverage options, including fresh food and hot meals, as well as services such as fuel pumps, ATMs, and even small grocery sections. Additionally, many convenience stores now offer online ordering and delivery services, catering to customers who prefer the convenience of ordering from home. The trend towards healthier and sustainable food options has also affected convenience stores insurance, with more stores now offering options such as organic produce and eco-friendly products.

What type of insurance do I need for a convenience store?

General Liability Insurance (GLI)

A type of insurance that protects a business from financial loss due to third-party claims of bodily injury or property damage. This type of insurance is designed to cover legal expenses and settlements that may arise from accidents or incidents that occur on your property or as a result of your business operations.

For example, let’s say a customer slips and falls on a wet floor in your convenience store. If they sue you for medical expenses and other damages, your General Liability Insurance policy would help cover the costs of your legal defense and any settlement or award.

Another example would be if a delivery truck damages a neighbor’s car while making a delivery to your store. If the neighbor sues you for damages, your GLI would help cover the cost of the legal defense and any settlement or award.

General Liability Insurance is a crucial coverage for any business, as lawsuits and settlements can be very expensive and disruptive to your business operations. By having GLI in place, you can have peace of mind knowing that you have financial protection in case of a third-party liability claim.

Business Interruption Insurance (BII)

A type of insurance coverage that provides financial protection for a business in the event of a temporary shutdown or interruption. BII covers the loss of income and extra expenses incurred by the business as a result of a covered event, such as a natural disaster, fire, or other unexpected event.

For example, let’s say a fire breaks out in your convenience store and you have to close the store for several weeks while repairs are made. During this time, you will not be able to generate income from the store, but you still have ongoing expenses such as rent, utilities, and employee salaries. Your Business Interruption Insurance policy would help cover these ongoing expenses, as well as provide a portion of the lost income that would have been earned if the store was operational.

Business Interruption Insurance is an important coverage for any business, as it helps protect against the financial loss and uncertainty that can result from unexpected events. By having BII in place, you can minimize the financial impact of a business interruption and ensure that your business can continue to operate and recover as quickly as possible.

Commercial Property Insurance

A type of insurance that provides coverage for damage to or loss of a business’s property, such as buildings, equipment, inventory, and fixtures. This type of insurance helps protect a business from financial loss due to events such as fire, theft, vandalism, and weather-related events.According to the National Fire Protection Association, from 2014 to 2018 there was an estimated average of 5,020 gas station fires throughout the nation, resulting in $20 million in direct property damage.

For example, let’s say there is a fire in your convenience store. The fire causes damage to the building and contents, such as the interior fixtures, equipment, and inventory. Your Commercial Property Insurance policy would help cover the cost of repairing or replacing the damaged property, up to the policy limits.

Another example would be if someone breaks into your store and steals the cash register and other valuable items. Your Commercial Property Insurance policy would help cover the cost of replacing the stolen items, up to the policy limits.

Commercial Property Insurance is an important coverage for any business that owns or leases physical property. By having this insurance in place, you can have peace of mind knowing that you have financial protection in case of damage or loss to your business property.

Business Owners Policy (BOP)

A type of insurance package that combines several types of coverage into one policy, typically including general liability insurance, property insurance, and business interruption insurance. This type of insurance is designed to provide comprehensive coverage for small to medium-sized businesses, offering convenience and cost savings by bundling multiple types of coverage into one policy.

BOPs are designed to provide protection against common risks and liabilities faced by many businesses, and typically offer coverage for events such as property damage, liability claims, and loss of income due to business interruption. The exact coverage included in a BOP can vary depending on the specific policy and the needs of the business, but it is typically customizable to meet the unique needs of each business.

By purchasing a BOP, a business can have peace of mind knowing that it has coverage for many of the most common risks and liabilities it may face. Additionally, BOPs can be a cost-effective way for small to medium-sized businesses to obtain the insurance coverage they need, as the cost of a BOP is typically lower than the cost of purchasing each type of coverage separately.

Level3 Insurance is the leading provider of convenience store insurance in Houston, Texas. We offer a wide range of coverages to protect your business from the unexpected, including general liability, property damage, theft, and business interruption. Get a free quote today!

A commercial umbrella insurance policy (also known as “excess liability insurance”) covers a wide range of liabilities, including

Personal injury liability

Contractual liability

Vehicle liability, including aircraft & watercraft

Liquor law liability, and more

Other Insurances

Get In Touch

Asking a quote is absolutely free and of course without obligations.